Pipeline Management

A solution that helps you keep track potential investors and opportunities across every point of contact.

Automated trading can help you increase the efficiency of your trades – by enabling faster execution of your CFD trading strategies. Learn more about the benefits of our automated trading platforms and find out how they can add value to your strategy..

DOWNLOAD FORTUNE WEALTH FACTSHEET

Automated trading is a method of participating in financial markets by using a programme that executes pre-set rules for entering and exiting trades. As the trader, you’ll combine thorough technical analysis with setting parameters for your positions, such as orders to open, trailing stops and guaranteed stops. Auto trading enables you to carry out many trades in a small amount of time, with the added benefit of taking the emotion out of your trading decisions. That’s because all the rules of the trade are already built into the parameters you set. With some algorithms, you can even use your pre-determined strategies to follow trends and trade accordingly.

First, you will choose a platform and set the parameters of your trading strategy. You’ll use your trading experience to create a set of rules and conditions, and then your custom algorithm will apply the criteria to place trades on your behalf. These factors are normally based on the timing of the trade, the price at which it should be opened and closed, and the quantity. For example, ‘buy 100 Apple shares when its 50-day moving average goes above the 200-day average’. The automated trading strategy that’s been set will constantly monitor financial market prices, and trades will automatically be executed if predetermined parameters are met. The aim is to execute trades faster and more efficiently, and to take advantage of specific, technical market events..

With automated trading, you can:

Fit your strategy around your schedule – execute trades automatically, day or night

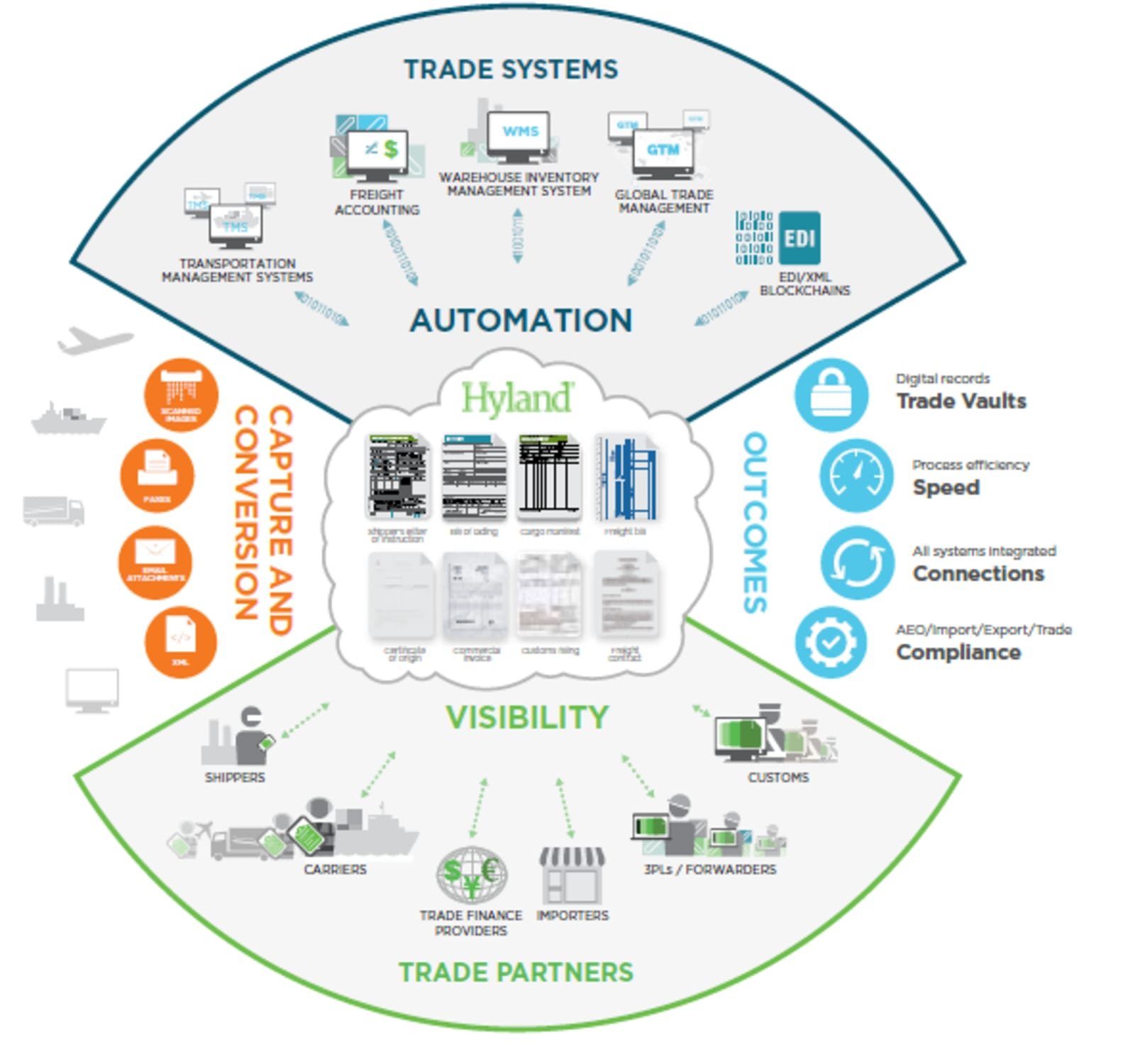

A solution that helps you keep track potential investors and opportunities across every point of contact.

Software that streamlines our firm's research,featuring easy integration into investment and trading tools.

A trade order solution that drives efficiency and transparency while steamlining daily trading workflows across any asset class.

A set of digital tools to help you integrate exposure and market data to meet complaince standards at all stages of trading.